Gainful

Simple, swift access right from your phone. Only a single document needed to apply

Simple, swift access right from your phone. Only a single document needed to apply

A responsible lending approach with a focus on security. We safeguard your information and provide help in tough spots

A simple, rapid solution from the comfort of your home. Instant money transfers and flexible loan periods

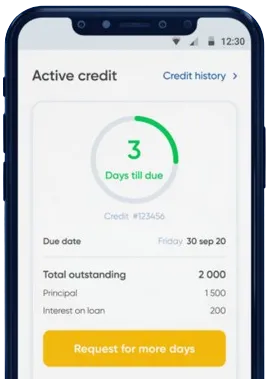

Submit an application via our app. Just fill out a simple form.

Expect a decision in as little as 15 minutes.

Accept your funds, normally transferred in about one minute.

Submit an application via our app. Just fill out a simple form.

Download loan app

Fast online loans have become increasingly popular in South Africa as a quick and convenient way to access financial assistance when needed. These loans provide a hassle-free process with minimal paperwork, making them an attractive option for many individuals facing unexpected expenses or emergencies.

Quick Approval: Fast online loans offer instant approval within minutes, allowing borrowers to access funds urgently.

Convenient Application Process: The online application process is simple and can be completed from the comfort of your own home or office.

Flexible Repayment Options: Borrowers can choose a repayment term that suits their financial situation, ranging from a few weeks to several months.

Fast online loans can be a lifesaver in various situations, including:

Emergency Expenses: Cover unexpected medical bills, car repairs, or home maintenance costs.

Debt Consolidation: Combine multiple debts into one manageable loan with lower interest rates.

Business Opportunities: Seize business opportunities or invest in a new venture with quick access to capital.

When considering fast online loans in South Africa, it is essential to research and compare different lenders to find the best option for your needs. Look for providers with:

Transparent Terms and Conditions: Ensure that you understand the interest rates, fees, and repayment terms before committing to a loan.

Positive Customer Reviews: Read reviews from previous borrowers to gauge the lender's reputation and customer service quality.

Consider using comparison websites to compare interest rates, loan amounts, and repayment terms from multiple lenders.

Check the lender's accreditation and licensing to ensure they comply with regulatory requirements.

In conclusion, fast online loans in South Africa offer a convenient and efficient solution for individuals in need of immediate financial assistance. With quick approval, flexible repayment options, and minimal paperwork, these loans can help address various financial challenges effectively. By choosing a reputable online loan provider and understanding the terms and conditions, borrowers can access funds quickly and responsibly manage their finances.

A fast loan online is a type of loan that is applied for and processed entirely over the internet, allowing borrowers to receive funds quickly without the need for extensive paperwork or in-person meetings.

To apply for a fast loan online in South Africa, you can visit the website of a reputable lender, fill out the online application form, submit the necessary documents electronically, and wait for approval.

The eligibility requirements for a fast loan online in South Africa typically include being a South African citizen or permanent resident, being over 18 years of age, having a regular source of income, and having a valid bank account.

With a fast loan online, funds are typically disbursed within 24 hours of approval, making it a convenient option for those in need of immediate financial assistance.

Interest rates for fast loans online in South Africa can vary depending on the lender, the amount borrowed, and the repayment term. It is important to carefully review the terms and conditions before accepting a loan offer.

Some lenders in South Africa offer fast loans online to borrowers with bad credit, but the interest rates may be higher. It is important to compare loan offers and consider the impact on your overall financial situation before applying.